Crypto is far more than just Bitcoin. As blockchain technology continues to advance, we’re diving deeper into the fascinating world of Web3.

Everyday, we see another crypto venture emerge. Ranging from DeFi startups to Metaverse software companies, the crypto space is becoming more crowded and competitive.

In this dynamic landscape, you need a well-crafted crypto marketing strategy. Launching a crypto project is one challenge, but effectively marketing it is another.

With such intense competition in the crypto space, simply placing a few ads won’t guarantee success. Instead, you’ll need a strategy that spans multiple verticals to truly realise your project’s potential.

This article will explore how to create a successful crypto marketing strategy. It will highlight key components of an effective strategy, share success stories from top crypto start ups, and offer actionable tips for your own project.

Table of contents

What Is Crypto Marketing?

Crypto marketing is all about boosting awareness, adoption, and engagement with cryptocurrency projects, NFTs, and other blockchain technologies.

It includes various strategies like creating content, social media engagement, partnering with influencers, building communities and managing public relations. Ultimately, the aim is to educate potential users, attract investors, create a loyal following and boost revenue.

But the crypto space faces a lot of challenges like regulatory shifts and market volatility. This makes the crypto industry incredibly fast paced and disruptive, making it difficult for brands to stay ahead and establish themselves as leaders.

And this is why an effective crypto marketing strategy is important!

The best strategies leverage data, use specific targeting, understand trends, and foster innovation. In the end, your success depends on your agility and responsiveness to fast-paced environments.

What Is the Difference Between Crypto Marketing and Regular Marketing?

Crypto marketing is any digital marketing campaign designed to help a crypto company grow its awareness, exposure, community, and revenue.

Well, you might be thinking to yourself…

‘OK, isn’t that the exact same thing as a regular marketing campaign?’

Well, yes, and no.

You see, while all marketing campaigns are inherently similar – in that they are aimed at growth, crypto marketing is a bit different.

The truth is that crypto marketing strategies play by a different set of rules. They’re based in certain (digital) places, they respond to certain phrases, and they expect certain things. Simply put, crypto is its own unique subculture.

Here are some key differences:

- Medium and channel: A crypto marketing strategy is decentralised and makes use of social platforms, forums, blogs, crypto-related websites and KOL relationships.

- Emphasis on trust: Since crypto is still an emerging industry, messaging mainly focuses on educating audiences about its benefits and opportunities. It is also focused on creating a community and building trust, due to its dubious past. Traditional marketing tends to be more promotional and focused on gaining new leads.

- Target audience: Crypto marketing strategies target a niche market of tech-savvy people that are interested in blockchain technology. Traditional marketing targets broader audiences based on demographics and other characteristics.

As mentioned – the crypto market is so volatile that the large majority of startups go out of business within a year.

Because of this, your crypto startup has to put extra focus on building trust and growing a real community, all while increasing the amount of hype for your project.

Here are 4 ways to take your crypto marketing campaign to the moon.

4 Most Effective Crypto Marketing Strategies

#1 – Content Marketing (Example – Cardano & VeeFriends)

Cryptocurrencies are still pretty new and unfamiliar territory.

While Bitcoin has been around for well over a decade, crypto-adoption rate is still quite low across the world.

Because of this, many people are still learning about crypto, and aren’t completely certain of what they are getting themselves into.

This is why content marketing should be a key part of your crypto marketing strategy.

Think of it as a means to educate your potential customers. Leveraging this lack of information and creating helpful content, is not only educational, it can also raise brand awareness and make crypto companies more accessible to wider audiences.

Some examples of content marketing are…

- Blog posts and discussion articles that act as educational resources.

- Explainer videos and online tutorials.

- FAQ sections on websites and social media.

- Webinars and livestreams with experts to discuss latest trends, projects and hold interactive Q&A sessions.

- Podcasts and interviews with developers and founders.

Pros of Content Marketing

✅ Builds Trust

✅ SEO benefits

✅ Educates customers

Cons of Content Marketing

❌ Difficult to scale

❌ Requires in-depth knowledge of product and crypto space

While Bitcoin has been around for well over a decade, the truth is that the crypto-adoption rate is still quite low across the world.

Because of this, many people are still learning about crypto, and aren’t completely certain of what they are getting themselves into.

That’s where content marketing comes into play.

Think of content marketing as a means to educate your potential customers. By doing this you will be able to teach them not just about your company, but about blockchain as a whole.

Some examples of content marketing are…

- Blog posts

- Beginner guides

- Knowledge hubs

- FAQs

- Glossary

- Webinars

- And more

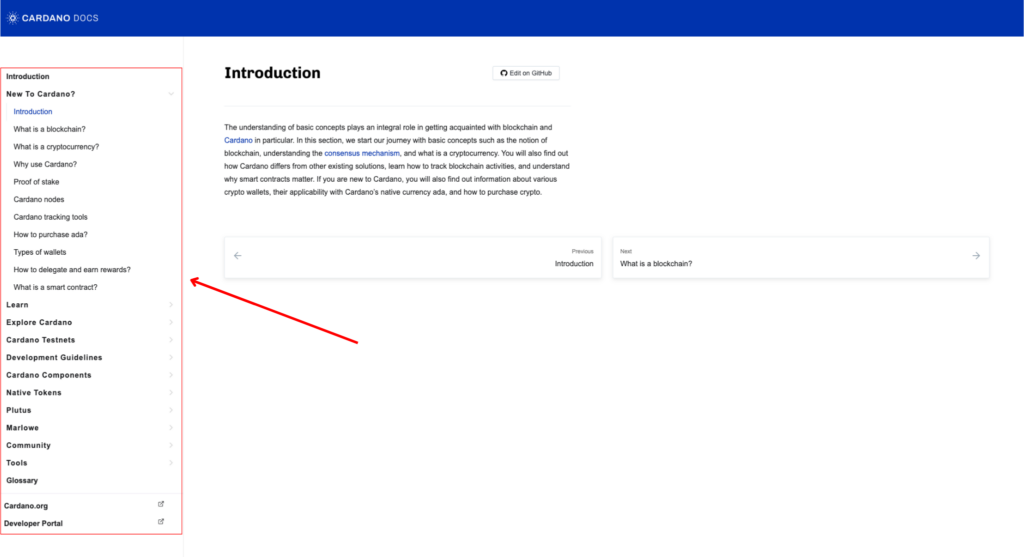

Below you can see the website for Cardano (ADA).

They have built out an entire hub to educate their users not only on the benefits of their product but also on cryptocurrency and blockchain as a whole.

Another example is VeeFriends – a popular NFT project by Gary Vaynerchuck.

VeeFriends publishes a lot of helpful blog posts and tutorials about the industry and their products – often multiple times a day!

These two examples show the power of content marketing.

Creating premium content to educate and promote, is central to an effective crypto marketing strategy. Essentially, your goal is to establish your project as a thought leader in the crypto space, build trust and a loyal following of potential users.

#2 – SEO (Example – Binance)

SEO is just as important in crypto marketing as it is in traditional marketing.

A good crypto marketing strategy uses effective SEO tactics to enhance visibility on search engine results, and drive more traffic towards your website.

The increased visibility leads to greater brand awareness, which enhances credibility and trust.

This will make sure that potential users and investors looking for reliable crypto projects, land on your site and are more likely to convert.

This goes hand-in-hand with effective content marketing. The more quality content you have, the more Google will see you as an authority and rank your pages higher.

Some things you can do to optimise SEO are…

- Keyword research: Find short-tail and long-tail keywords that focus on general terms (like “cryptocurrency”) and specific queries (like “what is blockchain technology?”).

- Optimise content: Incorporate keywords into your content. Create blog posts, videos and live streams that centre around some of the most popular keywords.

- Build backlinks: Build backlinks with reputable crypto related websites. This will increase your credibility and make you more visible to users.

Pros of SEO

✅ Easier to scale

✅ Can bring in traffic

✅ Allows you to create a funnel

Cons of SEO

❌ Difficult to do in-house

❌ Very competitive

Let’s look at Binance’s SEO…

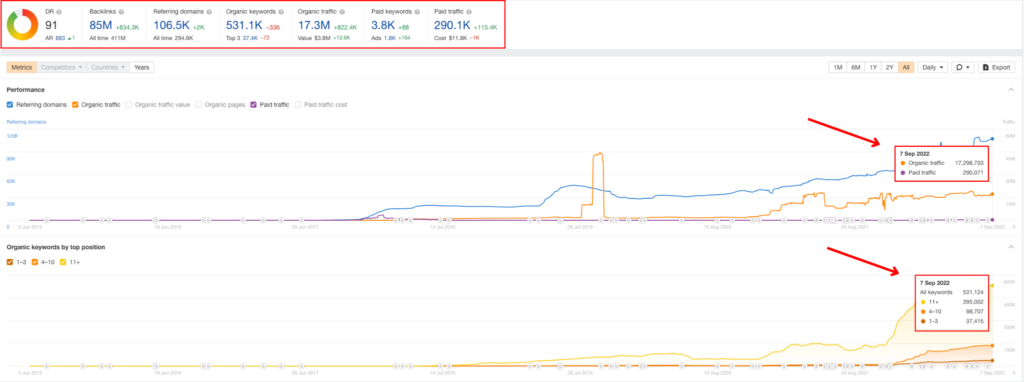

As you can see, Binance is pouring a TON of resources into their SEO – and it’s really paying off.

Binance is getting 17 million monthly visits from SEO with 530,000 ranking keywords (of which, 37,000 are in the top 3 results). This has helped them generate over 85 million backlinks and an absurdly impressive DR rating of 91.

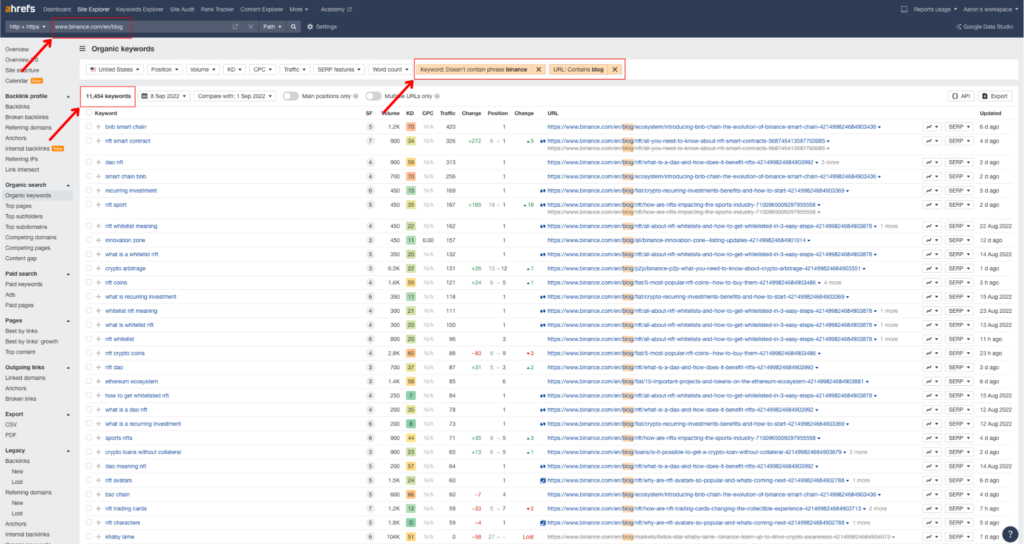

And this isn’t just for branded searches, look at what happens when we filter out ‘Binance’ and just look at the traffic that just goes to their blog.

That’s right, Binance’s blog is ranking for over 11,000 non-branded keywords.

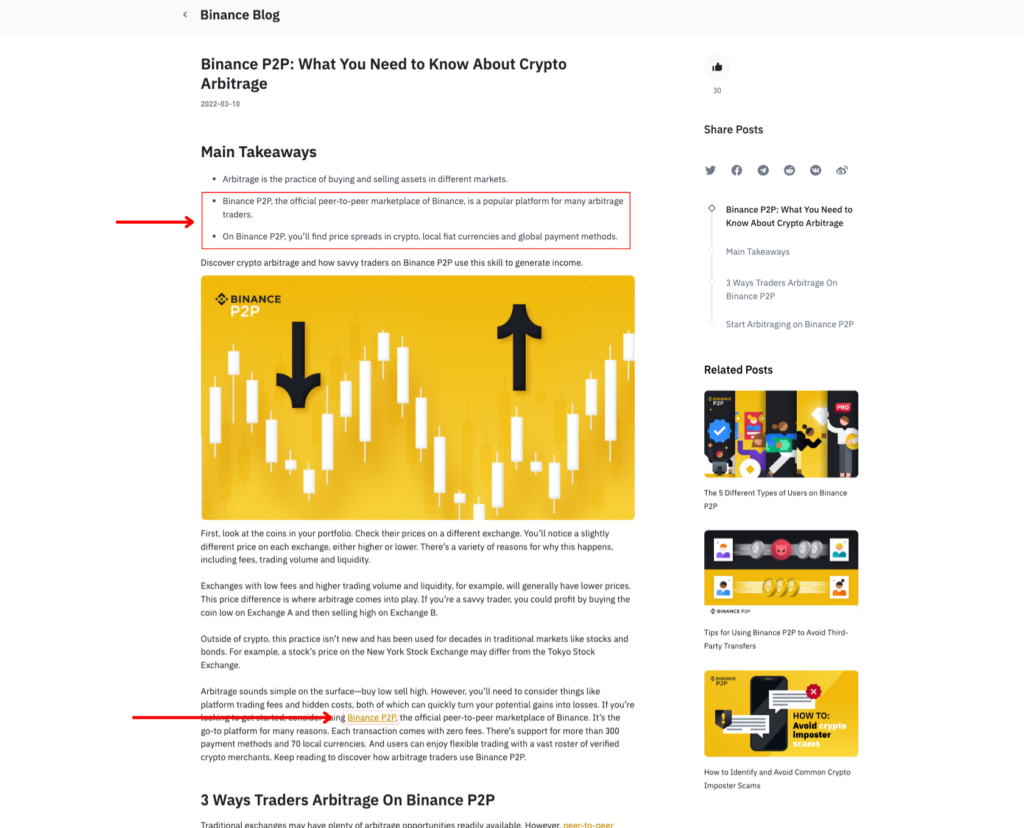

These articles are written with a keyword in mind, are crafted to educate searchers, and most importantly…

They are bringing searchers down their funnel.

SEO isn’t as easy as it used to be, but if you work with a professional agency, you can use SEO to your business’ advantage to get traffic and convert that traffic to lifelong customers.

#3 – Email marketing (Example – Coinbase)

A crypto marketing strategy that uses email marketing, can help companies generate new leads, nurture existing companies, keep users engaged and maintain loyal customers.

It’s also one of the most cost effective ways to directly reach users with news, announcements and promotions – with the average ROI being $36 for every $1 spent.

Email marketing also lets you better understand and target your customers, by segmenting them based on demographics, location, interests, and other factors. This makes sure you’re not wasting your time or money!

Pros of Email Marketing

✅ High engagement rates

✅ Ability to nurture leads

✅ High conversion rates

Cons of Email Marketing

❌ ESPs can be challenging to master

❌ High stakes – you can’t un-send emails!

Unlike SEO, which is one of the best ways to generate new leads, email marketing is best seen as a way to nurture existing leads and customers.

But very few crypto companies do this.

Let’s take a look at Coinbase, one of the few that use email marketing in their crypto marketing strategy.

One of the world’s leading crypto exchanges, Coinbase takes its email marketing very seriously. They use email marketing to nurture leads, keep its user base up to date with industry trends, and educate its customers about its many products.

There are email lead magnets spread throughout the entire site…

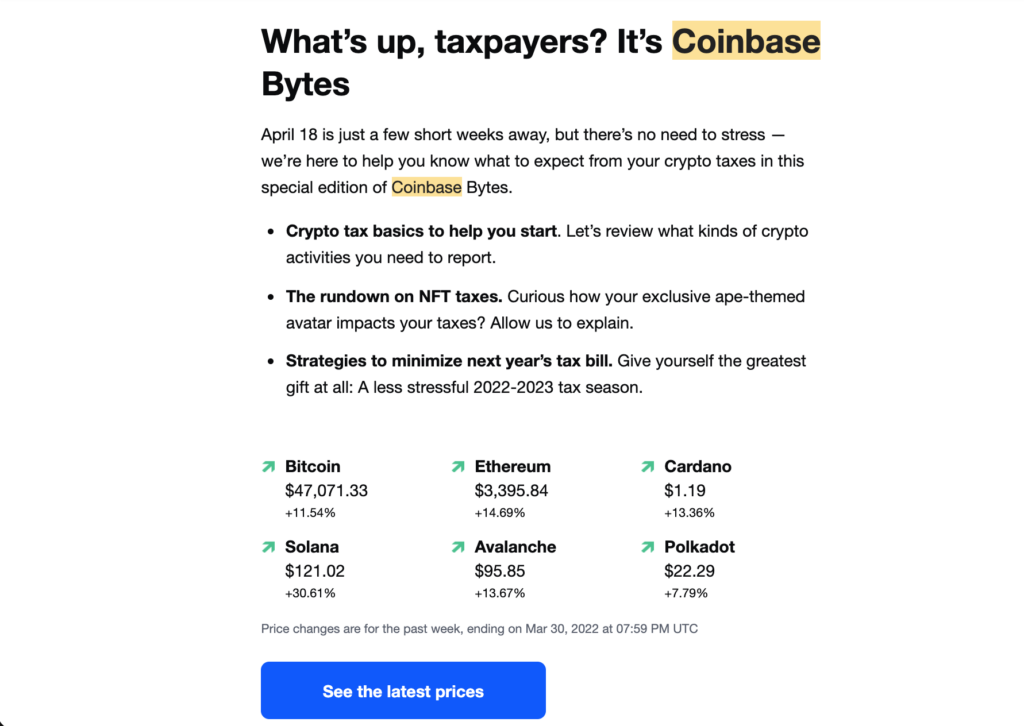

And once you sign up, you get weekly emails about what’s happening in the crypto world – an email series referred to as “Coinbase Bytes”.

These emails aren’t designed to hard-sell their subscribers. In fact, quite the opposite. They are extremely well-written and well-designed, which helps create a sense of trust in their user base. The emails provide so much value that subscribers end up appreciating the Coinbase brand, which makes them more likely to continue using and referring their products.

It’s important to remember that email marketing is a truly unique marketing strategy.

Why?

Google could delist you from their search engine. YouTube could ban you from their platform. Instagram could vanish overnight. But your email list? Well, that’s yours forever, and no one can take it from you.

Plus, compared to engagement rates on social media platforms, Email Marketing still delivers the best ROI out of all marketing platforms.

Because of this, email marketing is a one-of-a-kind marketing platform that truly can transform your crypto marketing strategy, and elevate the relationship you have with your customers and community.

Here are some ways you can get started:

- Airdrop campaign: distribute free cryptocurrency tokens to incentivise email signup.

- Build opt-in forms on landing pages.

- Offer exclusive content and deals for email signups.

#4 – Influencer Marketing (Example – FTX)

Influencer marketing is one of the most effective crypto marketing strategies.

Tapping into the loyal fanbase of macro/ micro influencers is essentially a fast-track to building trust and boosting brand exposure.

Crypto influencers are key opinion leaders in a largely uncharted field. They also have a highly primed audience that looks to them for information and guidance. This gives them immense power to dictate which trends and projects take off in the crypto space.

Partnering with these influencers can put your brand in the spotlight. Harnessing their reach can help you stand out in a competitive market and establish your own loyal community that are ready to purchase from you.

Pros of Influencer Marketing

✅ Can be cost-effective

✅ UGC performs well

✅ Ability to up-cycle content

Cons of Influencer Marketing

❌ Difficult to scale

FTX is a large crypto exchange that gets influencer marketing right. In fact, it was a key contributor to growing its revenue from $8 million in 2019 to $32 billion just a few years later!

Sure, they brought on some mega-influencers such as Tom Brady, Steph Curry, and Naomi Osaka, but they also ran numerous campaigns where they employed smaller social media influencers from around the world.

FTX found influencers who had overlapping audiences, and hired them to create content in a series called ‘Crypto in 60 Seconds’.

These videos were published on all corners of social media and contributed greatly to FTXs growth in the past few years.

Some of the influencers have massive followings, others have more modest followings.

And the best part about influencer marketing is that you can use the content and repurpose it for paid social media ads or for content on your website (like FTX did).

This is something FTX did and it made their content feel organic, granting their start-up a sense of the all-important credibility that can’t be manufactured.

This is so effective that viewers are nearly 2.4 times as likely to watch UGC (user-generated content) than they are traditional ads.

Final Thoughts

From content marketing to influencer partnerships, a comprehensive crypto marketing strategy is crucial for succeeding in a volatile crypto market.

NFTs, DAOs, Defi – it doesn’t matter what crypto-vertical your startup is in – the fundamentals remain the same.

The most successful crypto companies leverage diverse strategies to build trust, create awareness, and foster communities to scale and grow.

By adapting to the nuances of this evolving landscape and implementing these proven tactics, you can help your crypto project for success in today’s Web 3 era.

The high-stakes crypto sector brings a lot of unique challenges. Are you ready to boost your growth and make your mark?

Contact First Page today – the global agency turning ambitions into achievements

Get powerful results to lead the market!

We know you want to make real money! Get ready to convert customers like crazy. What are you waiting for? Contact us today!

People Also Ask

What should I look for in a crypto marketing agency?

The most important thing to look for in a crypto marketing agency is experience – not only with Web3, but also getting results in Web2. If their website has information about Web3 and they also have a track record of getting results in Web2, then it’s certainly worth reaching out to them.

Where can I market my crypto start-up?

There is no set playbook for where to market your crypto start-up – it really depends on where your audience hangs out online. Some of the most obvious places are Twitter, Reddit, Discord, and Instagram, but there might be some quicker wins available. Be sure to do audience research to find out which platforms will be most effective for your startup.

Why is crypto marketing important?

Crypto is no longer a fringe industry. It is highly competitive, and because of numerous scams, it’s harder (and more important) than ever to build trust and authority. A great crypto marketing campaign can help you achieve this, which in turn will result in massive growth for your crypto company.