NFT-awareness is growing exponentially. Especially with its rise and fall!

But amidst all of the growing awareness, most people only know about NFTs in their most basic form – as a piece of digital art or a rare digital asset.

Even with the recent fall in value of NFTs, more and more celebrities are starting projects, NFT commercials appeared during the Super Bowl, and now over two-thirds of freelancers on Fiverr are marketing their own NFT services.

And yet, the value of NFTs can be so much more than that.

Sure, a Crypto Punk selling for 23 million USD is cool and all, but this is only scraping the surface of what blockchain technology is capable of.

Enter; NFT smart contracts & royalties.

Smart contracts are the REAL game-changing value of NFTs because they allow businesses, creators, and artists to monetize their brand perpetually, while also empowering their customers and fans with the financial rewards of digital ownership.

In this article, we’ll give you a behind-the-scenes look at how NFT smart contracts work, so you can see for yourself why they are so revolutionary.

You’ll also see a few real-life examples of people who are innovating NFT smart contracts and changing the way creators, businesses, and their customers can generate income.

Royalties IRL (in real life)

Royalties are nothing new. The concept has existed in its most basic form for as long as money has existed.

But technology has helped creators and businesses achieve royalty at scale.

It started with television, and then with the advent of the internet, it developed into a whole new world – streaming. Now artists can put their music on Spotify or Apple and earn money (a royalty) every time someone streams one of their songs.

Royalties are also collected in other industries including sales of books, patents, concerts, and even natural resources.

But while royalties exist in the real world, there are limits to their use cases.

For instance, if an artist paints a picture and sells it for $100 to a buyer… it’s over. The artist has given up ownership of the picture, and if the buyer of the picture resells it at a later point in time, the original artist might never see a piece of that action.

This is where NFTs are changing the game.

Royalties in NFTs

NFTs give artists, creators, and businesses the ability to collect royalties perpetually.

Let’s use the same scenario as before. If the artist were to sell the picture as an NFT for $100 and the buyer resold the picture at a later point in time, the original artist could receive a royalty on that sale.

And not only on that sale – ALL future sales.

Every time the asset is resold, the royalties are automatically taken from the sale price and deposited into the crypto wallet of the original creator.

This is possible because of smart contracts.

What is an NFT smart contract?

NFTs exist because of crypto technology, and they are most commonly minted and traded on the Ethereum blockchain.

We don’t need to get into the technical jargon regarding Ethereum’s coding structure. I’m a marketer, not a blockchain engineer.

But ultimately Ethereum is coded in a way where you can create smart contracts that set rules for all future transactions related to the digital asset.

In their essence, smart contracts help create secure relationships over the internet. Smart contracts are similar to ordinary contracts – but the main difference is they are entirely digital, which means the contract is self-executing, trackable, and irreversible.

Smart contracts also help to eliminate 3rd parties in contracts. Fewer middlemen equals faster execution and more money for the creator.

And it should be noted, you can get very creative with smart contracts. I’ve seen NFTs that automatically destroy themselves after they exceed too many sales. Why you would want to implement that in your smart contract, I have no idea, but with smart contracts, anything is possible.

Let’s take a look at some real-life smart contract examples in a few different industries.

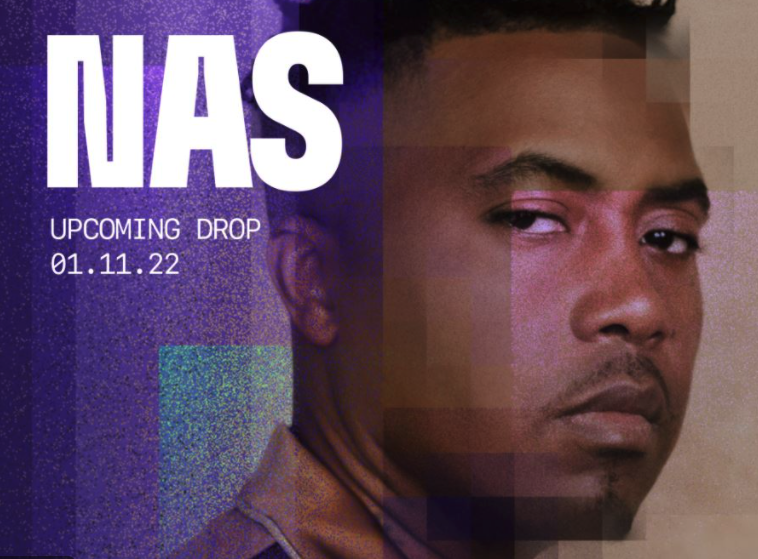

Example #1 – Nas

Nas is an award-winning and critically acclaimed American Hip Hop artist. In January of 2022, he sold a portion of the rights to two of his songs – ‘Ultra Black’ and ‘Rare’ – as NFTs on Royal. Royal is a blockchain-based music investment platform that is looking to change the way music is distributed and owned, as well as how artists get paid.

For the drop, Nas split ownership of these two songs in half. Nas kept 50% ownership of both songs, and he sold the other 50% to the owners of the 1,870 NFTs that were minted.

The NFTs varied in price, costing anywhere from $50 USD to $10,000 USD. The more you spent, the larger percentage of ownership of the song you had – ownership percentages range from .01% to 1.5%.

And here’s the amazing part – because of the smart contract, owners of this NFT will collect royalties anytime these songs are streamed. AND, certain NFTs in the collection give owners up to 21% earned royalties for every single resell.

The NFT collection sold out in less than 5 seconds. Nas made millions of dollars worth of ETH, and his fans now own a digital asset that not only expresses who they are, but that can also greatly appreciate in value, and give them royalties of their own.

Example #2 – Justin Aversano

Justin Aversano is a portrait photographer. He was trying to sell physical prints of his photographs, but someone recommended he look into selling them as NFTs.

So he transferred his photographs to the digital world and minted his ‘Twin Flames’ collection as an NFT.

The 100 NFTs in the collections sold out in 5 months, netting Aversano over $130,000 USD in sales.

Not bad eh?

Well here’s where it gets more interesting…

Even though the collection completely sold out, his revenue has grown tenfold.

How is it still growing?

Because of the smart contract.

In it, Aversano made sure that he received a 10% royalty every single time his NFTs were resold.

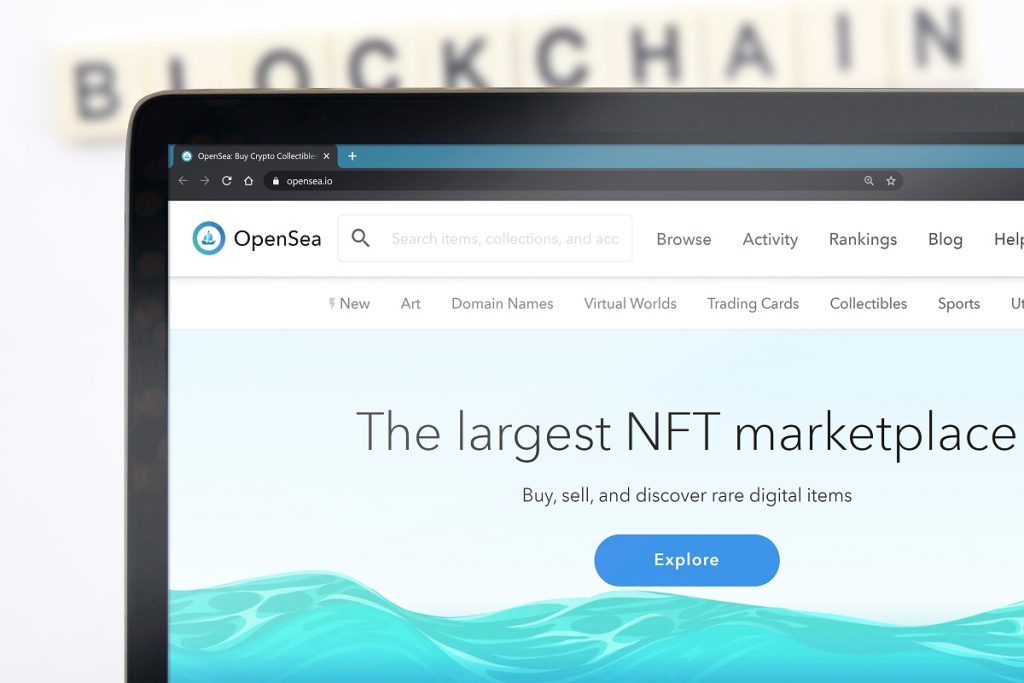

Well, since then, Aversano’s collection blew up, and has a resell volume of over 12 million USD on OpenSea, netting him an additional 1.2 million USD in royalty sales.

Example #3 – VeeFriends

Entrepreneur, investor, and one of the biggest influencers in social media, Gary Vaynerchuk launched his NFT project VeeFriends in April of 2021.

And while Vaynerchuk is a bit of a controversial figure, there’s no denying that his collection truly raised the NFT-bar.

Not only does every NFT owner get their digital asset, but they also get access to VeeCon in 2022, 2023, and 2024. VeeCon is an annual business and marketing conference that is ONLY available to owners of a VeeFriends NFT. This year, the conference has an impressive list of speakers including Snoop Dogg, Charli D’Amelio, Beeple, Logan Paul, and more.

Let’s talk money.

There were 10,250 NFTs in the collection, and it sold out in a few days, which generated over 51 million USD in revenue.

Vaynerchuk also implemented a 10% royalty in his smart contract for any resells on OpenSea. Vaynerchuk claims that this has generated him an additional 40 million USD in revenue.

Final thoughts on smart contracts and royalties with NFTs

While royalties and contracts exist outside of the digital world, they don’t function with the same efficiency as smart contracts.

Smart contracts are changing the way we look at digital assets, ownership, and royalties as a whole. They are not only empowering artists, creators, and businesses, but they are also giving fans and customers the ability to have ownership over digital assets that can appreciate in value.

It’s all really game-changing stuff! And while NFTs are only in their infancy, the future looks bright for the world of digital assets minted on the blockchain.

If you are considering starting your own NFT project and want to take it to the moon, be sure to reach out to one of our Digital Strategists. We’ll put together a next-level marketing plan that explodes awareness and sales of your unique collection.

Disclaimer – this article is meant to educate and entertain, but it is not financial advice. Please always be sure to do your own research.